The science and art of security come down to two things: quantifying and managing risk. Do both of those things well, and you’re much better positioned to prioritize your exposures and protect your organization.

In Episode 5 of our SON OF A BREACH! podcast series, CRITICALSTART CTO Randy Watkins kicks off a two-part series focused on the finances behind security. Our CFO Andrew Kaufman joins Watkins to calculate the value of security and the cost of risk for your business.

“I don’t think you can ever take a risk profile to zero, especially in cybersecurity,” Kaufman says. “You never know what else is out there and what threat actors are doing and concocting. …The goal is not reducing your liability to zero, it’s about reducing your liability to a point you can get comfortable around.”

Tune in to Episode 5 of SON OF A BREACH! below.

Kaufman’s accounting and financial leadership includes more than 16 years of experience in software, technology, and creating internal controls in financial reporting, particularly for high-growth technology firms. With that experience, he’s able to bring calculations of “cost impact x probability = quantifiable risk” to life with real-world examples.

“There are going to be times where the cost is just too high to mitigate the risk,” he says. “We recognize there is an open liability, but the cost to either install internal controls, or place technology around it, may be too high. That may be a point in time we look at transferring risk. That’s where the cyber risk policies and cyber risk insurance have really stepped up in the last several years.”

Q&A – Quest for Limited Liability with Andrew Kaufman

The following is an abbreviated Q&A based on Watkins’ conversation with Kaufman in Episode 5 of our SON OF A BREACH! podcast series. Be sure to tune in to the entire conversation.

Watkins: Let’s start with talking about quantifying and managing risk. As CFO, how would you start in calculating risk if you’re a CISO?

Kaufman: Cybersecurity really was bred out of a compliance checkbox approach. There’s regulation: how do I stay in tune with that regulation, and stay compliant with that regulation? But that doesn’t really, objectively go after the risk associated with a cybersecurity attack. I think from the CISO seat, it needs to be less about mitigating controls and more about outcomes. What are the potential outcomes that could happen from a cybersecurity breach, or a malware incident, or anything like that? What are those outcomes and what am I trying to prevent? Then you start looking at how much risk is associated with each one of those events.

Watkins: Risk is impact times probability. We’re looking at what’s the cost of this going to be if it happens. That often seems to be the point where a lot of people get stuck. Where do those dollar amounts come from?

Kaufman: For every organization, you’ve got to think about what is the potential that I’m going to have downtime, or I’m going to have loss of revenue, or I’m going to have a denial of service that’s going to cause me this amount of heartburn. It’s really getting down to each organization’s operations and understanding how a potential cyber event may affect that organization. So if an attack puts me out of commission for a day, what are my operating costs for that day? What is my loss of revenue for that day? If I lose data, what is the cost of going and spinning up backup? And how long will it take me to get back online?

The CISO doesn’t necessarily have to do this in a vacuum. They may want to quantify certain amounts of things that could occur in a cyber breach. But the CFO can help come behind that with true dollar figures of loss of revenue, costs associated with downtime, all of those things.

Watkins: You can spend all day qualifying and quantifying the risk, but you have to make a decision on that risk eventually. Once you have the risk calculated by the dollar amount, then what would you expect to see put into that?

Kaufman: The threat landscape today is not going to look the same as it does six months from now, with how fast threat actors are moving, evolving, etc. Once you get to that probability-times-cost output, it’s really important to run sensitivity analysis on it. In the event your probability changes, what type of change is that going to make to my overall exposure risk?

And it’s important that this doesn’t only occur within the CISO’s organization. So it’s getting others involved, it’s bringing this information to light at the executive level. You’re seeing a lot more corporate governance board involvement in cybersecurity risk, because it’s become such an area of major liability. And so you want to bring those (calculations) to those individuals, and let them also ascertain whether they think the outcomes, the dollar amounts, and the probabilities associated, seem reasonable.

![]()

Ransomware in 2025: The Real Risk, the Gaps That Persist, and What Actually Works

Ransomware attacks aren’t slowing down. They’re getting smarter, faster, and more expensive. In ...![]()

Security Operations Leaders: The Chaos Is Real

If you’re a CISO, SOC leader, or InfoSec pro, you’ve felt it. Alert volumes spike. Tools multipl...![]()

Transform Vulnerability Management: How Critical Start & Qualys Reduce Cyber Risk

In a recent webinar co-hosted by Qualys and Critical Start, experts from both organizations discusse...![]()

H2 2024 Cyber Threat Intelligence Report: Key Takeaways for Security Leaders

In a recent Critical Start webinar, cyber threat intelligence experts shared key findings from the H...![]()

Bridging the Cybersecurity Skills Gap with Critical Start’s MDR Expertise

During a recent webinar hosted by CyberEdge, Steven Rosenthal, Director of Product Management at Cri...![]()

2024: The Cybersecurity Year in Review

A CISO’s Perspective on the Evolving Threat Landscape and Strategic Response Introduction 2024 has...![]()

Modern MDR That Adapts to Your Needs: Tailored, Flexible Security for Today’s Threats

Every organization faces unique challenges in today’s dynamic threat landscape. Whether you’re m...![]()

Achieving Cyber Resilience with Integrated Threat Exposure Management

Welcome to the third and final installment of our three-part series Driving Cyber Resilience with Hu...Why Remote Containment and Active Response Are Non-Negotiables in MDR

You Don’t Have to Settle for MDR That Sucks Welcome to the second installment of our three-part bl...![]()

Choosing the Right MDR Solution: The Key to Peace of Mind and Operational Continuity

Imagine this: an attacker breaches your network, and while traditional defenses scramble to catch up...![]()

Redefining Cybersecurity Operations: How New Cyber Operations Risk & Response™ (CORR) platform Features Deliver Unmatched Efficiency and Risk Mitigation

The latest Cyber Operations Risk & Response™ (CORR) platform release introduces groundbreaking...![]()

The Rising Importance of Human Expertise in Cybersecurity

Welcome to Part 1 of our three-part series, Driving Cyber Resilience with Human-Driven MDR: Insights...![]()

Achieving True Protection with Complete Signal Coverage

Cybersecurity professionals know all too well that visibility into potential threats is no longer a ...![]()

Beyond Traditional MDR: Why Modern Organizations Need Advanced Threat Detection

You Don’t Have to Settle for MDR That Sucks Frustrated with the conventional security measures pro...The Power of Human-Driven Cybersecurity: Why Automation Alone Isn’t Enough

Cyber threats are increasingly sophisticated, and bad actors are attacking organizations with greate...Importance of SOC Signal Assurance in MDR Solutions

In the dynamic and increasingly complex field of cybersecurity, ensuring the efficiency and effectiv...The Hidden Risks: Unmonitored Assets and Their Impact on MDR Effectiveness

In the realm of cybersecurity, the effectiveness of Managed Detection and Response (MDR) services hi...![]()

The Need for Symbiotic Cybersecurity Strategies | Part 2: Integrating Proactive Security Intelligence into MDR

In Part 1 of this series, The Need for Symbiotic Cybersecurity Strategies, we explored the critical ...Finding the Right Candidate for Digital Forensics and Incident Response: What to Ask and Why During an Interview

So, you’re looking to add a digital forensics and incident response (DFIR) expert to your team. Gr...![]()

The Need for Symbiotic Cybersecurity Strategies | Part I

Since the 1980s, Detect and Respond cybersecurity solutions have evolved in response to emerging cyb...![]()

Critical Start H1 2024 Cyber Threat Intelligence Report

Critical Start is thrilled to announce the release of the Critical Start H1 2024 Cyber Threat Intell...![]()

Now Available! Critical Start Vulnerability Prioritization – Your Answer to Preemptive Cyber Defense.

Organizations understand that effective vulnerability management is critical to reducing their cyber...![]()

Recruiter phishing leads to more_eggs infection

With additional investigative and analytical contributions by Kevin Olson, Principal Security Analys...![]()

2024 Critical Start Cyber Risk Landscape Peer Report Now Available

We are excited to announce the release of the 2024 Critical Start Cyber Risk Landscape Peer Report, ...Critical Start Managed XDR Webinar — Increase Threat Protection, Reduce Risk, and Optimize Operational Costs

Did you miss our recent webinar, Stop Drowning in Logs: How Tailored Log Management and Premier Thre...Pulling the Unified Audit Log

During a Business Email Compromise (BEC) investigation, one of the most valuable logs is the Unified...![]()

Set Your Organization Up for Risk Reduction with the Critical Start Vulnerability Management Service

With cyber threats and vulnerabilities constantly evolving, it’s essential that organizations take...![]()

Announcing the Latest Cyber Threat Intelligence Report: Unveiling the New FakeBat Variant

Critical Start announces the release of its latest Cyber Threat Intelligence Report, focusing on a f...Cyber Risk Registers, Risk Dashboards, and Risk Lifecycle Management for Improved Risk Reduction

Just one of the daunting tasks Chief Information Security Officers (CISOs) face is identifying, trac...![]()

Beyond SIEM: Elevate Your Threat Protection with a Seamless User Experience

Unraveling Cybersecurity Challenges In our recent webinar, Beyond SIEM: Elevating Threat Prote...![]()

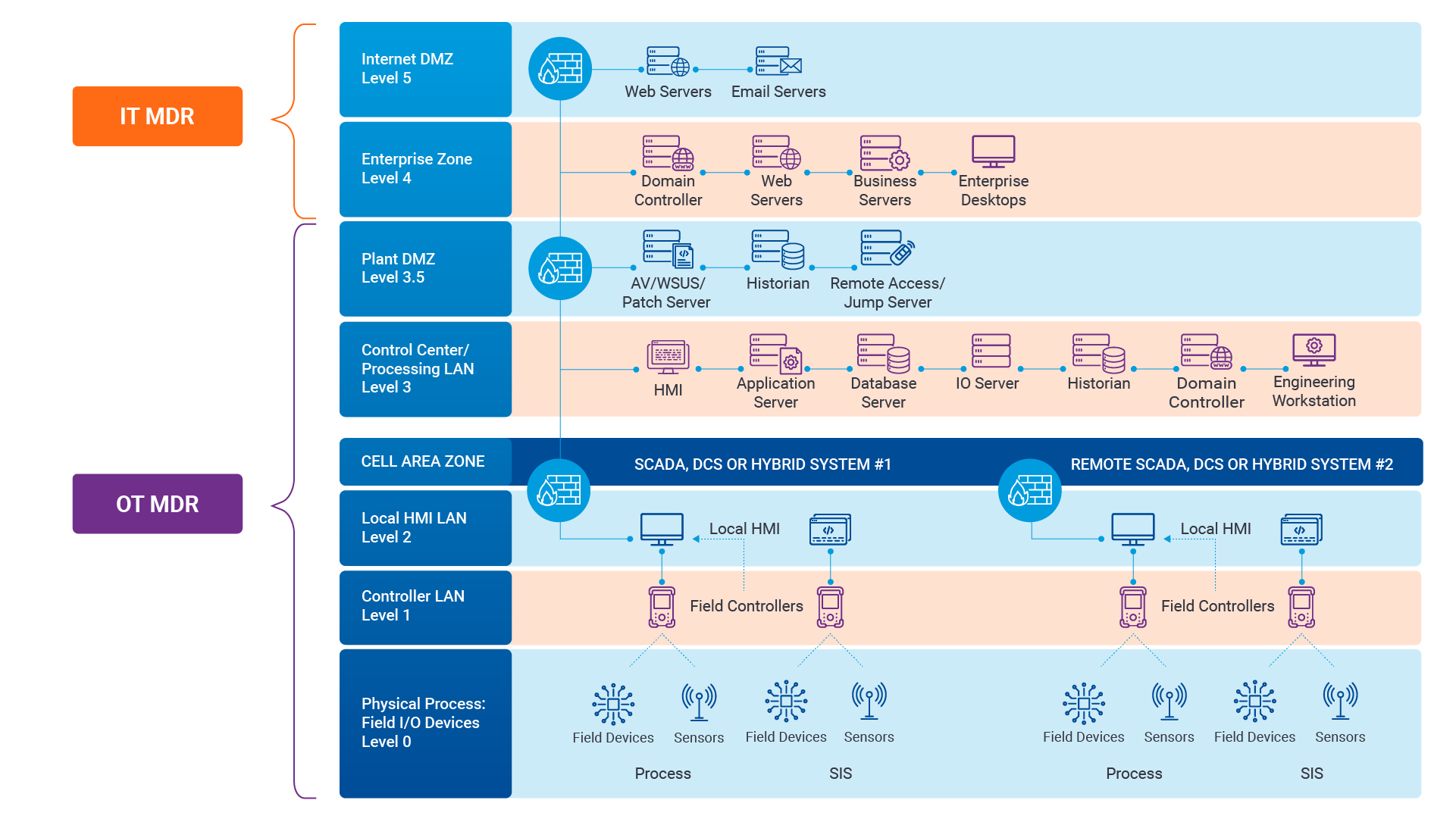

Navigating the Convergence of IT and OT Security to Monitor and Prevent Cyberattacks in Industrial Environments

The blog Mitigating Industry 4.0 Cyber Risks discussed how the continual digitization of the manufac...![]()

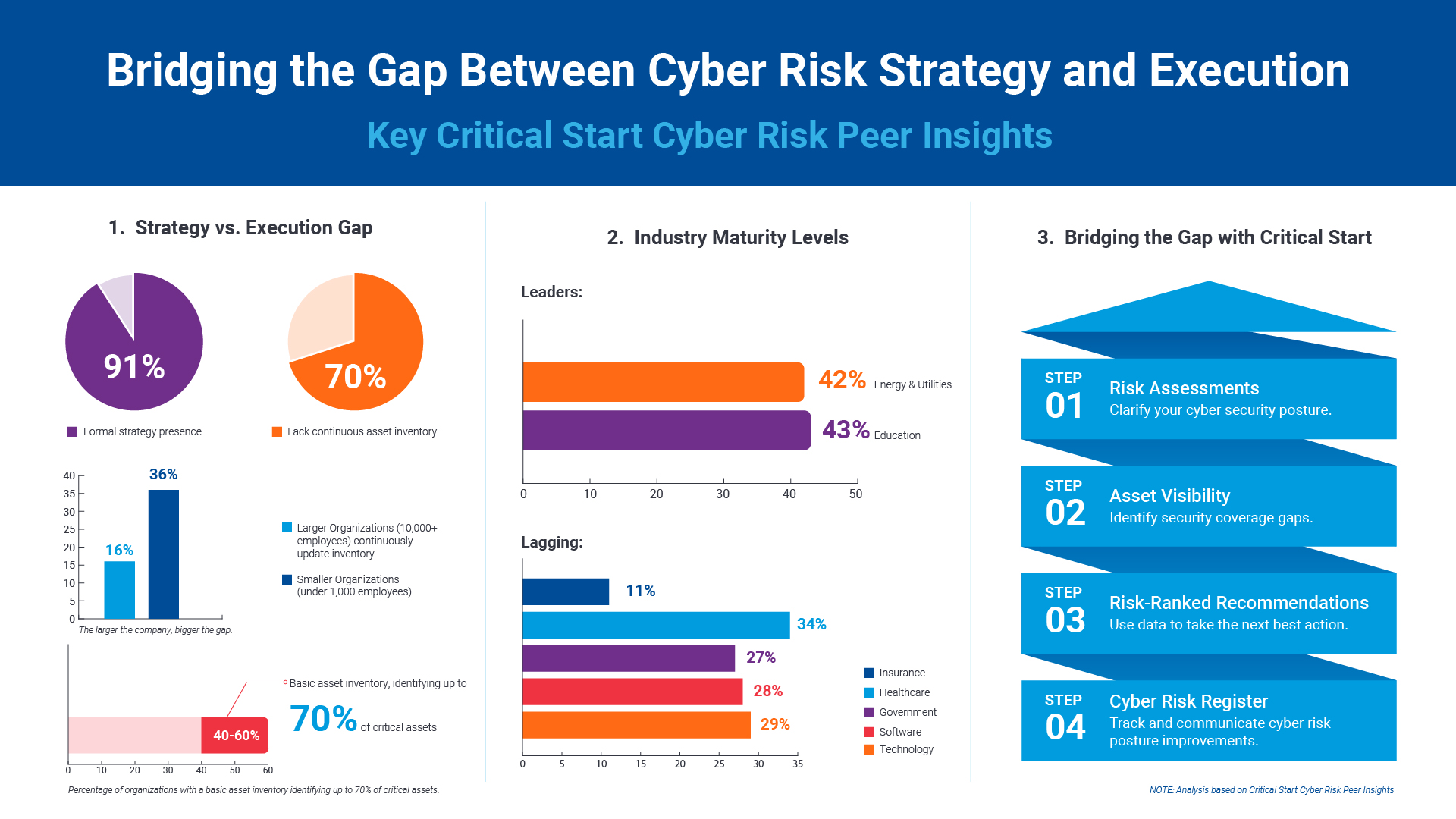

Critical Start Cyber Risk Peer Insights – Strategy vs. Execution

Effective cyber risk management is more crucial than ever for organizations across all industries. C...![]() Press Release

Press ReleaseCritical Start Named a Major Player in IDC MarketScape for Emerging Managed Detection and Response Services 2024

Critical Start is proud to be recognized as a Major Player in the IDC MarketScape: Worldwide Emergin...Introducing Free Quick Start Cyber Risk Assessments with Peer Benchmark Data

We asked industry leaders to name some of their biggest struggles around cyber risk, and they answer...Efficient Incident Response: Extracting and Analyzing Veeam .vbk Files for Forensic Analysis

Introduction Incident response requires a forensic analysis of available evidence from hosts and oth...![]()

Mitigating Industry 4.0 Cyber Risks

As the manufacturing industry progresses through the stages of the Fourth Industrial Revolution, fro...![]()

CISO Perspective with George Jones: Building a Resilient Vulnerability Management Program

In the evolving landscape of cybersecurity, the significance of vulnerability management cannot be o...![]()

Navigating the Cyber World: Understanding Risks, Vulnerabilities, and Threats

Cyber risks, cyber threats, and cyber vulnerabilities are closely related concepts, but each plays a...The Next Evolution in Cybersecurity — Combining Proactive and Reactive Controls for Superior Risk Management

Evolve Your Cybersecurity Program to a balanced approach that prioritizes both Reactive and Proactiv...![]()

CISO Perspective with George Jones: The Top 10 Metrics for Evaluating Asset Visibility Programs

Organizations face a multitude of threats ranging from sophisticated cyberattacks to regulatory comp...![]() Datasheet

DatasheetCRITICALSTART® Advisory SOC Analyst (ASA)

Discover how Critical Start’s Advisory SOC Analyst (ASA) service adds personalized expertise to yo...![]() Datasheet

DatasheetMDR Use Cases

Discover how Critical Start MDR delivers rapid, SLA-backed threat detection and response across your...- Webinar

Are Critical Threats Slipping Through Your Defenses?

Modern security teams are buried in noisy alerts and stretched thin. Even with powerful tools like M...

Newsletter Signup

Stay up-to-date on the latest resources and news from CRITICALSTART.

Thanks for signing up!